Global Corn Starch Industry: Key Statistics and Insights in 2025-2033

Summary:

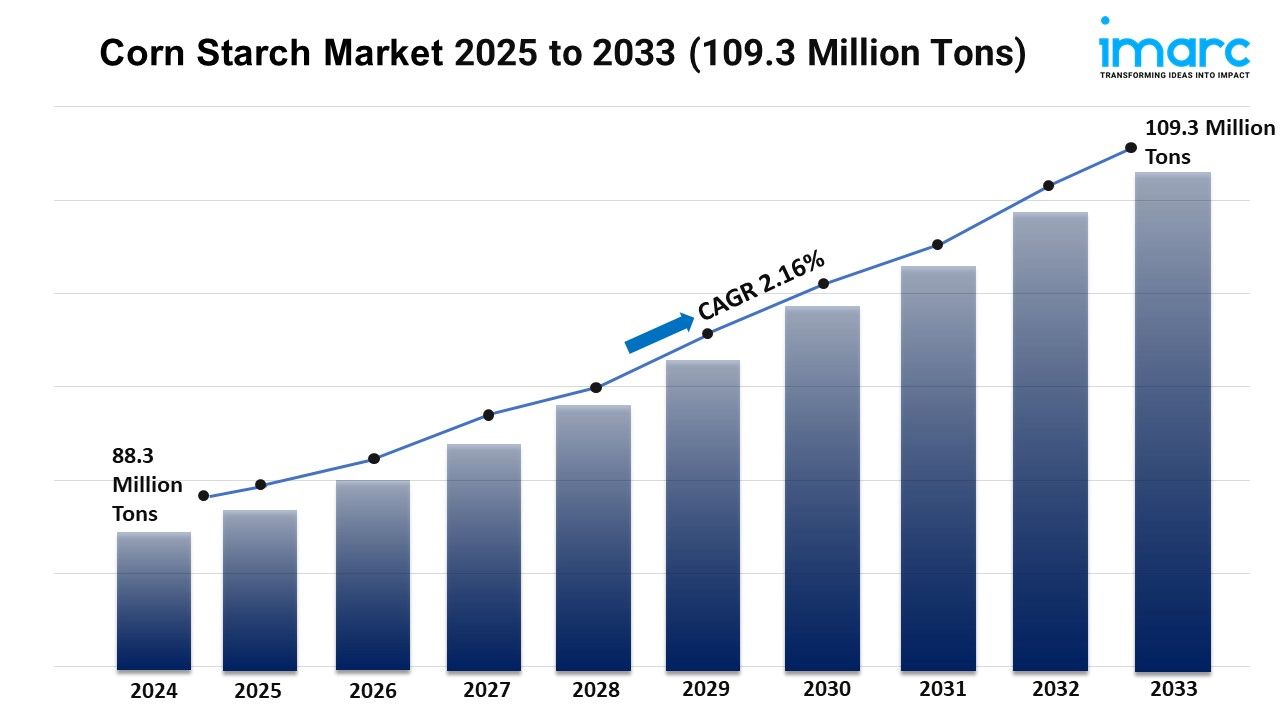

- The global corn starch market size reached 88.3 Million Tons in 2024.

- The market is expected to reach 109.3 Million Tons by 2033, exhibiting a growth rate (CAGR) of 2.16% during 2025-2033.

- The United States leads the market, accounting for the largest corn starch market share.

- Sweeteners represent the majority of the market share in the category segment as they contribute to the preservation and extension of the shelf life of many food products.

- Food & beverages hold the biggest share in the corn starch industry.

- The rising demand in the food and beverage (F&B) sector is a primary driver of the corn starch market.

- The growth in biofuel production and expansion in industrial applications are reshaping the corn starch market.

Request for a sample copy of this report: https://www.imarcgroup.com/corn-starch-manufacturing-plant/requestsample

Industry Trends and Drivers:

- Growing Demand in the Food and Beverage (F&B) Industry:

Due to its make-to-order functional involvement in food manufacture and applications, the Food and Beverage industry forms a very significant market for cornstarch. Corn starch performs the roles of a thickener, stabilizer, and texturizer, thus used in such products as sauces, soups, and baked cereals. Now, the out-look of the market is favorably attracted by the increasing demand for corn starch that arises due to rising demand for convenience food items, especially among busy people. At this time, the shelf-life also seemed to grow rapidly, according to processed and ready-to-eat (RTE) food items among consumers worldwide. The gluten-free and allergen-free health trends have also made corn starch a reasonable alternative to wheat-based thickeners. A growing requirement prevails also for low-calorie and functional ingredients among health-conscious consumers.

- Growth in Biofuel Production:

The current feedstock that serves the bioethanol production process is corn starch. Such focus on sustainability has triggered the market's expansion in efforts to reduce Greenhouse Gas (GHG) emissions. The bioethanol from this corn starch is commonly mixed in fuel as it is now one of the mandates posted by countries like the United States and Brazil regarding the use of biofuels. Additionally, most governing agencies of the various countries have lined up plans to invest in renewable energy, and most of all, advancements in biofuels production processes have added to the efficiency in lowering the cost to produce, making corn starch an even more attractive feedstock. This in turn adds to the strength of the biofuels industry and provides assistance to the economies dependent on corn for agriculture.

- Expansion in Industrial Applications:

Cornstarch has shown a lot of promise in its multitudes of industrial applications, mainly as binding, filling, and coating materials. In the papermaking industry, it is used to improve quality attributes of strength and smoothness, while in textiles, it acts as a sizing agent, which enhances fabric strength. In the pharmaceutical industry, low allergenicity and biodegradability of cornstarch make it a preferred tablet binder and filler. Cornstarch is, therefore, increasingly preferred in these sectors owing to its sustainable and natural trends act as an environment-friendly alternative to petroleum-based chemicals. Demand for cornstarch is also projected to increase with industrial development in emerging markets, more so in the Asia-Pacific region.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging corn starch market trends.

Corn Starch Market Report Segmentation:

Breakup By Category:

- Native Starch

- Modified Starch

- Sweeteners

Sweeteners account for the majority of shares as they contribute to the preservation and extension of the shelf life of many food products.

Breakup By Application:

- Food & Beverages

- Animal Feed

- Pharmaceuticals & Chemicals

- Textile

- Paper & Corrugates

- Others

Food & beverages dominate the market due to changing dietary patterns of individuals.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

The United States enjoys the leading position owing to a large market for corn starch driven by the presence of modern processing facilities.

Top Corn Starch Market Leaders:

The corn starch market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Cargill, Incorporated

- Archer Daniels Midland (ADM) Company

- Ingredion Incorporated

- Roquette Frères S.A

- Tate & Lyle PLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145